Entire generations of Soviet citizens grew up in a culture in which hard work and dedication promised an old age of reasonable comfort.

In those times, ‘retiring for a well deserved rest’ promised stability. For the majority of people, however, it didn’t work out that way.

After the fall of the Soviet Union, newly – born, independent nations inherited their predecessor’s system of social security. However, in the context of the new and struggling market economies, these new countries were unable to provide for those who had already retired: these people became the first victims of the ripples of destruction brought about by the 1990s.

A decade of high oil prices worked out well for the budgets and pension funds of Azerbaijan and Russia alike, but now, pensions in these countries are in such a state as to be able to only provide for very basic needs.

In poorer countries of the post – Soviet world, such as Moldova or Armenia, the elderly are barely able to make ends meet. There, the main income of a pensioner is not his or her pension, but rather the earnings of their children or grandchildren, who more often than not have gone abroad to find work.

To make matters more difficult, the population of the post – Soviet world is quickly aging, and so the load and burden on the budget will continue to grow as well.

According to the UN, by 2050, every 5th resident of countries of the former USSR will be older than 65. The current economic crisis in the region, which experts have been describing as the most difficult since the 1990s, has already brought a great deal of damage to the pension systems of these countries.

We looked at how pensioners in Russia, Belarus, Moldova, Georgia, Ukraine and Armenia live, 25 years after the fall of the Soviet Union. We not only analyzed the condition of the pension system, but also compared weekly expenses in each country.

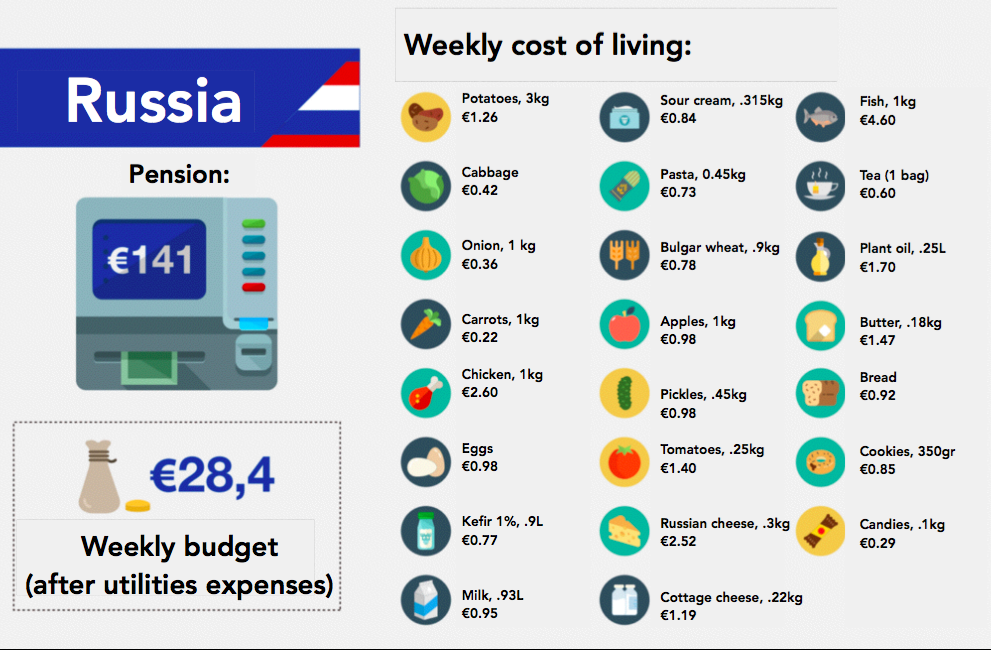

RUSSIA

Number of pensioners:

42,729,000 (30% of the population)

Retirement age:

60 (men), 55 (women)

Average pension size:

179 euros

The Russian pension system has undergone extensive reform in the past 2 decades, but has nonetheless retained its Soviet standard for the age of retirement – 60 for men, 55 for women. By world standards, this is rather young. Russia is also facing the problem of a quickly aging population.

The government has tried to raise the retirement age twice – generally during financial crises and when there was a need to decrease budget expenses. During the most recent economic crisis, the question was raised once again. However, analisysts argue whether the authorities will touch this issue before the presidential elections of 2018 or after.

As of 2017, government workers in Russia will be unable to retire until 65 (men), and 63 (women).

The average pension size according to Rosstat in September of 2016 was 12,440 rubles (179 euros). That is 34% of the average salary. The sum depends on the individual’s former occupation: the pension of employees of the Ministry of Foreign Affairs might be twice as high as the national average. Furthermore, there is a system of bonuses based off region and province. A large number of people still receive a pension that is below the living wage – 9,776 rubles or 141 euros.

Despite the few privileges that pensioners have (lower transportation, medical and utility fees), pensioners can spend up to half of their pensions on utilities and medicine. After the devaluation of the ruble in 2014, citizens’ salaries and those of pensioners began to fall for the first time in 15 years. According to statistical data, one out of three pensioners continues to work.

Another important source of income, especially for residents of Moscow and other large cities, is the renting out of homes and apartments. As during Soviet times, one of the main sources of additional income for the retired is work on small, personal plots of land and the aide of working relatives.

UKRAINE

Number of pensioners:

12,297,000 (29% of population)

Retirement age:

65 (men), 60 (women)

Average pension size:

61 euros

As is Russia, Ukraine is currently undergoing a deep demographic crisis and the quantity of pensioners is growing and growing. In 2015 alone, the number of retired citizens increased by 1% in the country.

2 years ago, the number of registered pensioners outnumbered the number of tax payers.

During the presidency of Viktor Yanukovich, pension reform gradually increased the retirement age to 65 for men and 60 for women. The retirement age will continue to rise by half a year until 2022.

The official size of the average pension does not correspond to the reality of the situation, however, because people who worked in government structures or who held high government posts receive a much higher pension, as do those who served in the army or other state institutions.

The average pension size in the beginning of 2016 was 1700 griven (61 euros). This is the lowest pension size in Europe. The Ukrainian pension system is, it would appear, bankrupt. The deficit of the pension fund has reached 5.2 billion euros.

GEORGIA

Number of pensioners:

867,000 (22% of population)

Retirement age:

65 (men), 60 (women)

Average pension:

70 euros

Old age retirement pensions in Georgia have been set at 180 lari (70 euros). More than 20% of pensions are received by residents of mountainous regions. Dwellers of mountainous regions earn an added bonus of 10 euros. For this region, many districts try to receive the status of ‘mountainous region.’ Pensions for work experience do not exist in Georgia, however, pensions are set for members of parliament after their term of service ends. They receive 208 euros a month.

Pensioners say that on average, they pay about 13 euros a month for utilities. For medicine, a minimum of 15 euros. Pensioners are automatically insured. This insurance however does not cover medicine, but those in need of immediate medical operations and other urgent issues are generally covered.

Starting in October of 2017, the government proposes to shift to a savings system which is more in line with practices in developed countries. The base part of the pension (and this concerns current pensioners as well) will be annually indexed. Both working citizens and their employers will contribute to the fund. It is assumed that those who will retire in the next 10 – 15 years will benefit most from these changes. Today’s pensioners can hope only for a higher set pension that will react to inflation.

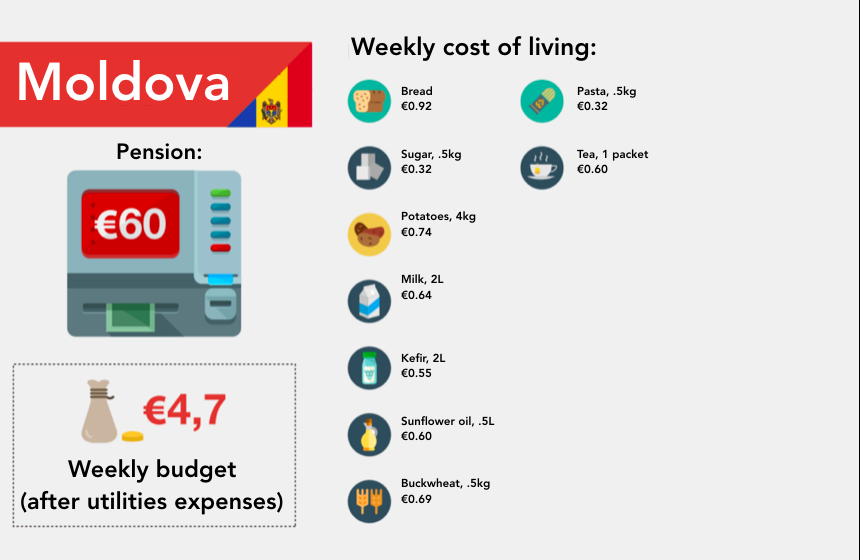

MOLDOVA

Number of pensioners:

700,000 (17% of population)

Retirement age:

62 (men) 57 (women)

Average pension:

59 euros

The average pension in Moldova is 1300 leus or 59 euros. This amount does not cover even half of the minimum amount needed for an elderly individual to get by. In fact, many pensioners receive only 700 – 800 leus or 32 – 36 euros.

However, 10% of pensioners receive higher than the minimum wage (in 2016, it was 5050 leu). These are generally former ministers, MPs, judges, prosecutors and other officials. After the latest indexation, the pensions of former judges reached 6500 leus (300 euros), up from 6100.

Besides pensions, some elderly people receive a social security bonus, especially during the cold seasons. This sum is set by the government at 316 leus or 16 euros.

Pension reform in Moldova began only in 1998. The retirement age for women was raised to 57 years, and for men to 62. It was assumed that by 2008, these respective ages would reach 60 and 65. However, this did not happen. A government initiative in 2011 was stalled. Now, for real pension reform in the country, aide from the International Monetary Fund is much needed, and the government of Moldova plans to take upon itself financial obligations.

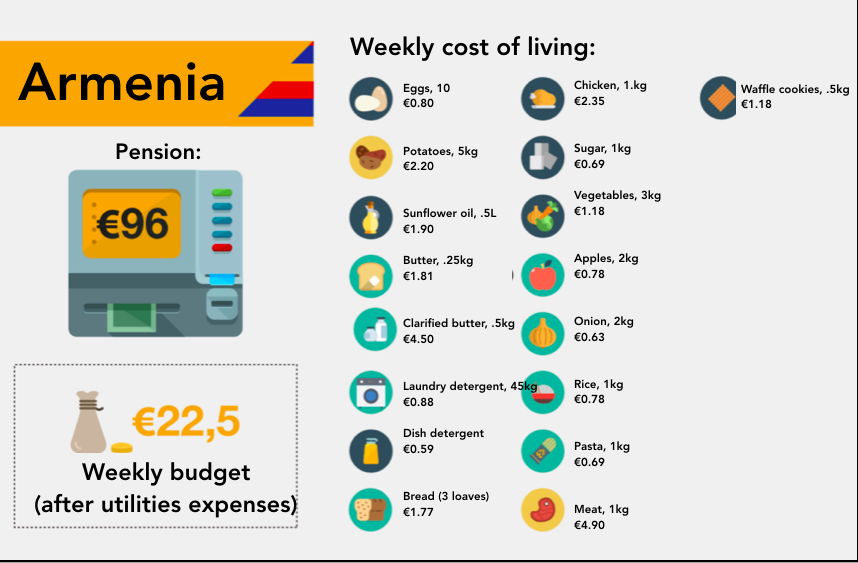

ARMENIA

Number of pensioners:

451,900 (15% of population)

Retirement age:

65 (men), 63 (women)

Average pension size:

80 euros

Old age retirement pensions are received after a minimum of 25 years work experience. After the latest increases in social handouts in 2015, the average pension size was raised by 14% to 41,000 drams (80 euros). Officers in the army receive around 87,000 (170 euros). Former high – placed officials can earn up to 1 million dram (1940 euros).

However, lowly paid pensioners complain that they are barely able to make ends meet. Armenia is not a wealthy country and in the past two years it has come face to face with a serious economic problem, as has its neighbors. Many work – able citizens of Armenia have left to work abroad – the level of emigration in Armenia is one of the highest in the world, and many of the pensioners have been left behind.

Pensioners say that they have to use their electricity sparingly, in addition to their gas and water. Heating in the winter months can reach up to 20 – 25 thousand dram (40 – 49 euros), and electricity costs them another 7 – 15 euros. Water costs them 5 – 6 euros.

Of course, medicines become more and more necessary with age. Pensioners spend about 9 – 29 euros on medicine per month. In the case of serious illnesses for those without children, problems with health become unavoidable. And then, they end up with very little left over for food. The elderly complain that meat, fish and chicken are almost entirely out of their reach. Or, if they can afford it, they can do so only once a month.

AZERBAIJAN

Number of pensioners:

1,299, 946 (13% of the population)

Retirement age:

63 (men), 60 (women)

Average pension size:

95 euros

New pension reform began in 2014 in Azerbaijan, the aim of which was to transfer to the savings pension system. From 2010, the retirement age was set at 63 for men and 60 for women.

From 2006, every worker has an individual account to which a portion of his or her salary is transferred. The base pension is supplied by the government to those who worked for 12 years and are of retirement age. The rest is dependent upon the savings acquired by the individual. There are allowances and bonuses for those who received a higher education, or for those, for example, who worked in a dangerous setting – such as at a chemical factory or petrochemical processing plant.

However, those who retired before 2006 can only count on the base pension.

The average pension in Azerbaijan is 177 manat (95 euros), the maximum – for those who have been deemed “national heroes” – is 1300 (715 euros). Considering the devaluation of the manat in the past two years and the growth of prices (inflation in 2016 was 12%), pensions in Azerbaijan generally do not entirely cover a person’s needs.

According to pensioners, of their 177 – manat monthly pension, around 30 goes towards utilities. 10 manat for transport, 20 manat for cleaning products, 20 manat for the most necessary medicines and the rest to food and small household needs, such as paying to replace a broken faucet. Serious treatment or the purchase of technology is almost impossible without the help of relatives. Pensioners who live on their own often live in poverty.

BELARUS

Number of pensioners:

2,500,000 (23% of the population)

Retirement age:

60 (men), 55 (women)

Average pension:

138 euros

According to Belstat, the average pension for age in Belarus as of October of 2016 was 291 rubles (138 euros). Pensions are raised according to the orders of the president not less often than once a year.

One tenth of the pension is eaten up by utilities: rent, electricity, gas, telephone. That is without considering internet and television fees. Medicine again eats up a large portion of pensions, with pensioners spending in between one third to half their pensions on health related services and items.

One forth of pensioners – and there are 2.5 million of them in Belarus – work. Those who continue to work past their retirement age are largely women.

As of January 1, 2017, the retirement age will rise by 6 months ever year until 63 years of age for men and 58 for women. Earlier, men retired at 60 and women at 55.

The size of the pension depends on one’s work experience, the position one held and the salary received. Again, former officials, MPs and military figures earn the most from their pensions.

It is difficult to survive on the average pension for most pensioners. For that reason, their relatives help them out. Many live off the dacha, and grow what they need to consume.

Project put together by: Olga Bulat, Kim Voronin, Giorgi Zedginidze, Artyom Martynovich, Natalya Marshalkovich, Gayane Mkrtchyan, Nadiya Apenko, Yuri Petrushevski, Maksim Eristavi