The Azerbaijani government is implementing certain reforms in the energy sector to maintain stable oil production. However, recent trends show that despite these reforms, the number of oil wells is decreasing. Among the reasons cited are declining productivity of old wells, Azerbaijan’s commitment to the 2020 OPEC+ agreement to reduce oil output, unprofessional management, and other contributing factors.

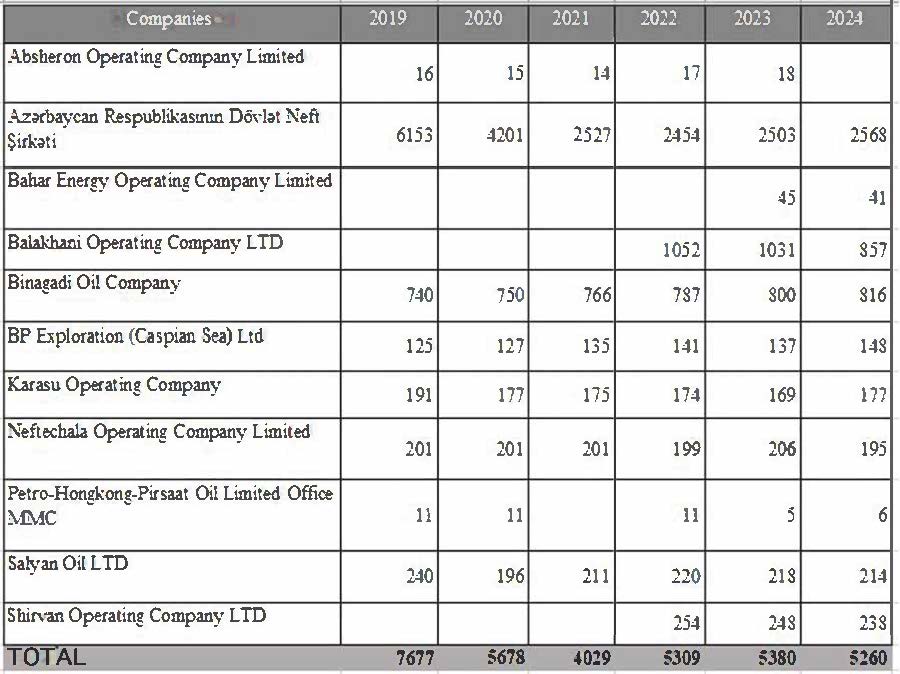

According to official data, statistics released in 2024 show that the number of oil wells decreased by 120 units compared to previous years. Last year, the number of operational wells across 11 companies was 5,260.

Meydan TV, referencing the State Statistics Committee’s “Transparency Report in the Extractive Industry,” reports that only 11 out of 45 companies involved in oil and gas production disclosed the number of wells. Accurate statistics for the remaining companies could not be obtained.

Operation of 2400 oil wells ceased over six years

The disclosed figures from 11 companies reveal that between 2019 and 2024, different trends were observed in the number of oil wells in Azerbaijan. In 2019, there were 7,677 wells, but this number fell to 5,678 in 2020 and further to 4,029 in 2021.

The most significant reduction occurred within the oil and gas production departments operating under SOCAR. In 2019, there were 6,153 operational wells, but by 2024, this figure had dropped by more than half to 2,568. Official statements attribute this decline to reduced productivity of old wells and rising operating costs. The state company also claims to prioritize stable production through fewer but more productive wells. However, it appears that stability in production has yet to be achieved.

Other companies reported the following:

Binagadi Oil Company increased the number of wells from 740 in 2019 to 816 in 2024, attributed mainly to technical modernization.

Balakhani Operating Company was added to the statistics in 2022, but in 2024, the number of wells dropped by 174.

BP Exploration (Caspian Sea) Ltd recorded an increase in the number of wells.

Salyan Oil LTD had 240 wells in 2019, which dropped to 214 in 2024.

Karasu Operating Company closed 22 wells since 2019 but was able to restore only 8.

Other companies such as Neftchala Operating Company, Petro-Hongkong-Pirsaat Oil Limited, and Shirvan Operating Company also showed a decrease in the number of wells.

A look at the table shows that the drop in well numbers peaked in 2020. That year, due to the pandemic, industrial activity worldwide was temporarily halted, sharply reducing the demand for oil.

In 2020, OPEC and non-OPEC countries agreed to cut daily oil production by up to 10 million barrels, with Azerbaijan committing to a reduction of 164,000 barrels per day. As part of this obligation, Azerbaijan had to scale back production. Consequently, both the depletion of natural resources and international commitments regarding production directly impacted the number of wells. Experts believe that restoring the numerous wells closed during those years is both a complex and costly process.

Statistics show that since 2019, investments in the oil sector have also decreased. While SOCAR invested nearly 1 billion manats in 2019, this figure fell to 574 million manats by 2024. Compared to 2023, investments dropped by 7.3 percent.

BP Exploration (Caspian Sea) Ltd also reduced its investments by 14 percent. This decline indicates waning interest in restoring wells and implementing new technologies.

“Shutting down oil and gas wells was a wrong decision both technologically and financially”

According to research by the Oil Workers’ Rights Protection Organization, the majority of well closures in 2020 occurred in fields under the control of “Azneft” PU. Nearly 3,000 of its wells had to cease operation. Specifically, 552 wells at Bibiiheybatoil, 441 wells at the Amirov NPU, 158 wells at the Taghiyev NPU, and 374 wells at Siyazanneft were shut down.

At the Oil Rocks (Neft Dashlari) site, 202 wells producing up to 7 tons per day were shut down in May–June 2020 to reduce daily production by 1,200 tons. In addition, 101 wells across 2 fields were closed due to planned changes in extraction methods (with total production of 290 tons), and 10 wells with clogged lift pipes and daily output of 30,000 cubic meters of gas (242 tons of oil) were taken out of operation.

From July to December of the same year, 44 wells producing 1 ton daily (37 tons total) were shut down to cut average daily output by 300 tons, along with another 101 wells across 2 fields (290 tons total).

The closure of these wells has had a significant impact on current production levels. Efforts to restore them have been weak, and as noted earlier, insufficient funds have been allocated. As a result, SOCAR prioritizes operating fewer, more productive wells with lower investment, while the restoration of old wells is seen as an additional financial burden.

One industry expert states that the complete shutdown of onshore and numerous offshore oil and gas wells in 2020 was a mistake from both technological and financial standpoints. According to him, returning onshore wells to operation after a shutdown costs millions of manats.

“When a well is stopped for a short or long period, it inevitably experiences technological complications. The filter section clogs, compressor pipes need replacement, and transport lines break down. Accumulated tar, oil, and sand crystallize in the pipes, making crude oil transportation impossible. The narrowing of pipe diameter increases pressure during transport and overloads the pumps. To solve these problems, kilometers of new pipelines must be laid.”

The expert adds that after a shutdown, tar and sand crystallization causes leaks in the pipes, and clamps installed on these lines cannot fully prevent leakage.

“This clamp issue is especially seen at the Oil Rocks. The most dangerous part is that old pipes are painted and reused under the guise of new ones. This problem exists across many divisions of ‘Azneft’ PU.”